🎓 Definition

CLV defines the value a customer will deliver to the Retailer during her lifetime, either from a cashflow perspective (sales) or profitably (margin) perspective.

There are several ways of calculating CLV, and one of the most detailed and well-explained approaches can be found in this article from Maryna Sharapa.

Measurement | Definition | Benefit |

Projected Sales Value or Projected Margin Value | The amount of sales value or margin value that a customer will deliver during her lifetime as a customer. | SEGMENTATION Identify the most valuable customers globally PLANNING & BUDGETING Determine the amount to be invested for Customers based on their level of importance to the Budget PROMOTION Planned promotions of Housewife Basket Items are a sure traffic driver. They should be accompanied with more premium items to balance the margin mix. |

Customer Lifetime Value (CLV) is a parameter that is customizable to user decisions.

🧪 Example of Customer Lifetime Value

For example, Store A sells maternity clothing and also toddler clothing, you might find that your pregnant customers have a low CLV because they only shop with you for a few months and the nature of the items are used temporarily. On the other hand, mothers with toddlers stay with you for 2 years (and probably shop with future kids as well) so, their CLV is higher.

❓What is CLV used for

• To understand how your Loyal Customers interacted with your business, predict how they may interact with you in the future and how much revenue Retailers tend to make from a single loyal customer.

• By estimating the value of a customer over their lifetime, Retailers can determine how much they are willing to spend to acquire a New Customer.

• To tell Retailers how much loyal customers are likely to spend during their time shopping, which can help Retailers find the right combination of short-term and long-term marketing strategies.

• To identify your top loyal customers based on their spending habits, a technique also known as ABC Analysis. This will give you more focus as you look to grow more profitable relationships with your current and future customers.

How do different industries or business models influence the calculation and interpretation of CLV?

Different industries and business models can significantly influence the calculation and interpretation of Customer Lifetime Value (CLV). For instance, the CLV for a subscription-based service, like a streaming platform, might focus more on the recurring revenue from subscriptions and the length of subscription retention. In contrast, for a retail store selling physical goods, the CLV might be influenced by factors such as purchase frequency, average transaction value, and product lifespan. Additionally, industries with higher competition or lower customer loyalty might require different strategies to increase CLV, such as enhancing customer experience or introducing loyalty programs.

What factors should be considered when segmenting customers to identify the most valuable ones?

When segmenting customers to identify the most valuable ones, several factors should be considered. These factors can include purchase frequency, average transaction value, product preferences, and overall profitability. Additionally, customer behavior, such as brand loyalty, engagement level, and response to marketing efforts, can also play a crucial role in segmentation. By analyzing these factors, retailers can gain a deeper understanding of their customer base and tailor their marketing and promotional strategies more effectively to enhance CLV.

How can Retailers adapt their marketing and promotional strategies based on CLV insights?

Retailers can adapt their marketing and promotional strategies based on CLV insights by focusing on both short-term and long-term approaches to maximize customer value. For example, for customers with high CLV, retailers might invest more in personalized marketing campaigns, loyalty programs, and exclusive offers to encourage repeat purchases and enhance customer loyalty. On the other hand, for customers with lower CLV, retailers might focus on targeted promotions to increase their spending or introduce upselling and cross-selling strategies to boost their average transaction value. By leveraging CLV insights, retailers can find the right balance between acquiring new customers and nurturing existing ones to optimize overall profitability.

🖥️ Make it happen in Ulys Customer Intelligence

How to access Customer Lifetime Value (CLV) in Ulys:1 Simple Steps

Step 1: Select Customer History Menu from the Menu Bar

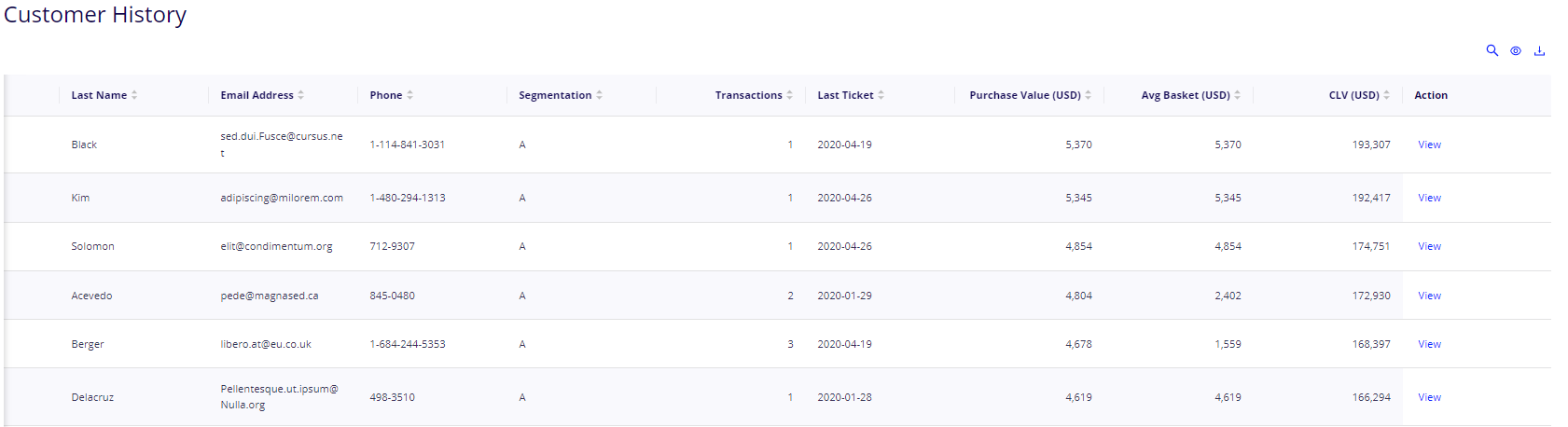

And here it is. Customer Lifetime Value for each Loyal customer is displayed on the CLV column.